To the Shareholders of Berkshire Hathaway Inc.:

Operating earnings improved to $41.9 million in 1980 from

$36.0 million in 1979, but return on beginning equity capital

(with securities valued at cost) fell to 17.8% from 18.6%. We

believe the latter yardstick to be the most appropriate measure

of single-year managerial economic performance. Informed use of

that yardstick, however, requires an understanding of many

factors, including accounting policies, historical carrying

values of assets, financial leverage, and industry conditions.

In your evaluation of our economic performance, we suggest

that two factors should receive your special attention - one of a

positive nature peculiar, to a large extent, to our own

operation, and one of a negative nature applicable to corporate

performance generally. Let’s look at the bright side first.

Non-Controlled Ownership Earnings

When one company owns part of another company, appropriate

accounting procedures pertaining to that ownership interest must

be selected from one of three major categories. The percentage

of voting stock that is owned, in large part, determines which

category of accounting principles should be utilized.

Generally accepted accounting principles require (subject to

exceptions, naturally, as with our former bank subsidiary) full

consolidation of sales, expenses, taxes, and earnings of business

holdings more than 50% owned. Blue Chip Stamps, 60% owned by

Berkshire Hathaway Inc., falls into this category. Therefore,

all Blue Chip income and expense items are included in full in

Berkshire’s Consolidated Statement of Earnings, with the 40%

ownership interest of others in Blue Chip’s net earnings

reflected in the Statement as a deduction for “minority

interest”.

Full inclusion of underlying earnings from another class of

holdings, companies owned 20% to 50% (usually called

“investees”), also normally occurs. Earnings from such companies

- for example, Wesco Financial, controlled by Berkshire but only

48% owned - are included via a one-line entry in the owner’s

Statement of Earnings. Unlike the over-50% category, all items

of revenue and expense are omitted; just the proportional share

of net income is included. Thus, if Corporation A owns one-third

of Corporation B, one-third of B’s earnings, whether or not

distributed by B, will end up in A’s earnings. There are some

modifications, both in this and the over-50% category, for

intercorporate taxes and purchase price adjustments, the

explanation of which we will save for a later day. (We know you

can hardly wait.)

Finally come holdings representing less than 20% ownership

of another corporation’s voting securities. In these cases,

accounting rules dictate that the owning companies include in

their earnings only dividends received from such holdings.

Undistributed earnings are ignored. Thus, should we own 10% of

Corporation X with earnings of $10 million in 1980, we would

report in our earnings (ignoring relatively minor taxes on

intercorporate dividends) either (a) $1 million if X declared the

full $10 million in dividends; (b) $500,000 if X paid out 50%, or

$5 million, in dividends; or (c) zero if X reinvested all

earnings.

We impose this short - and over-simplified - course in

accounting upon you because Berkshire’s concentration of

B

E

R

K

S

H

I

R

E

H

A

T

H

A

W

A

Y

I

N

C

.

�

resources in the insurance field produces a corresponding

concentration of its assets in companies in that third (less than

20% owned) category. Many of these companies pay out relatively

small proportions of their earnings in dividends. This means

that only a small proportion of their current earning power is

recorded in our own current operating earnings. But, while our

reported operating earnings reflect only the dividends received

from such companies, our economic well-being is determined by

their earnings, not their dividends.

Our holdings in this third category of companies have

increased dramatically in recent years as our insurance business

has prospered and as securities markets have presented

particularly attractive opportunities in the common stock area.

The large increase in such holdings, plus the growth of earnings

experienced by those partially-owned companies, has produced an

unusual result; the part of “our” earnings that these companies

retained last year (the part not paid to us in dividends)

exceeded the total reported annual operating earnings of

Berkshire Hathaway. Thus, conventional accounting only allows

less than half of our earnings “iceberg” to appear above the

surface, in plain view. Within the corporate world such a result

is quite rare; in our case it is likely to be recurring.

Our own analysis of earnings reality differs somewhat from

generally accepted accounting principles, particularly when those

principles must be applied in a world of high and uncertain rates

of inflation. (But it’s much easier to criticize than to improve

such accounting rules. The inherent problems are monumental.) We

have owned 100% of businesses whose reported earnings were not

worth close to 100 cents on the dollar to us even though, in an

accounting sense, we totally controlled their disposition. (The

“control” was theoretical. Unless we reinvested all earnings,

massive deterioration in the value of assets already in place

would occur. But those reinvested earnings had no prospect of

earning anything close to a market return on capital.) We have

also owned small fractions of businesses with extraordinary

reinvestment possibilities whose retained earnings had an

economic value to us far in excess of 100 cents on the dollar.

The value to Berkshire Hathaway of retained earnings is not

determined by whether we own 100%, 50%, 20% or 1% of the

businesses in which they reside. Rather, the value of those

retained earnings is determined by the use to which they are put

and the subsequent level of earnings produced by that usage.

This is true whether we determine the usage, or whether managers

we did not hire - but did elect to join - determine that usage.

(It’s the act that counts, not the actors.) And the value is in

no way affected by the inclusion or non-inclusion of those

retained earnings in our own reported operating earnings. If a

tree grows in a forest partially owned by us, but we don’t record

the growth in our financial statements, we still own part of the

tree.

Our view, we warn you, is non-conventional. But we would

rather have earnings for which we did not get accounting credit

put to good use in a 10%-owned company by a management we did not

personally hire, than have earnings for which we did get credit

put into projects of more dubious potential by another management

- even if we are that management.

(We can’t resist pausing here for a short commercial. One

usage of retained earnings we often greet with special enthusiasm

when practiced by companies in which we have an investment

interest is repurchase of their own shares. The reasoning is

simple: if a fine business is selling in the market place for far

less than intrinsic value, what more certain or more profitable

utilization of capital can there be than significant enlargement

of the interests of all owners at that bargain price? The

�

competitive nature of corporate acquisition activity almost

guarantees the payment of a full - frequently more than full

price when a company buys the entire ownership of another

enterprise. But the auction nature of security markets often

allows finely-run companies the opportunity to purchase portions

of their own businesses at a price under 50% of that needed to

acquire the same earning power through the negotiated acquisition

of another enterprise.)

Long-Term Corporate Results

As we have noted, we evaluate single-year corporate

performance by comparing operating earnings to shareholders’

equity with securities valued at cost. Our long-term yardstick

of performance, however, includes all capital gains or losses,

realized or unrealized. We continue to achieve a long-term

return on equity that considerably exceeds the average of our

yearly returns. The major factor causing this pleasant result is

a simple one: the retained earnings of those non-controlled

holdings we discussed earlier have been translated into gains in

market value.

Of course, this translation of retained earnings into market

price appreciation is highly uneven (it goes in reverse some

years), unpredictable as to timing, and unlikely to materialize

on a precise dollar-for-dollar basis. And a silly purchase price

for a block of stock in a corporation can negate the effects of a

decade of earnings retention by that corporation. But when

purchase prices are sensible, some long-term market recognition

of the accumulation of retained earnings almost certainly will

occur. Periodically you even will receive some frosting on the

cake, with market appreciation far exceeding post-purchase

retained earnings.

In the sixteen years since present management assumed

responsibility for Berkshire, book value per share with

insurance-held equities valued at market has increased from

$19.46 to $400.80, or 20.5% compounded annually. (You’ve done

better: the value of the mineral content in the human body

compounded at 22% annually during the past decade.) It is

encouraging, moreover, to realize that our record was achieved

despite many mistakes. The list is too painful and lengthy to

detail here. But it clearly shows that a reasonably competitive

corporate batting average can be achieved in spite of a lot of

managerial strikeouts.

Our insurance companies will continue to make large

investments in well-run, favorably-situated, non-controlled

companies that very often will pay out in dividends only small

proportions of their earnings. Following this policy, we would

expect our long-term returns to continue to exceed the returns

derived annually from reported operating earnings. Our

confidence in this belief can easily be quantified: if we were to

sell the equities that we hold and replace them with long-term

tax-free bonds, our reported operating earnings would rise

immediately by over $30 million annually. Such a shift tempts us

not at all.

So much for the good news.

Results for Owners

Unfortunately, earnings reported in corporate financial

statements are no longer the dominant variable that determines

whether there are any real earnings for you, the owner. For only

gains in purchasing power represent real earnings on investment.

If you (a) forego ten hamburgers to purchase an investment; (b)

receive dividends which, after tax, buy two hamburgers; and (c)

receive, upon sale of your holdings, after-tax proceeds that will

�

buy eight hamburgers, then (d) you have had no real income from

your investment, no matter how much it appreciated in dollars.

You may feel richer, but you won’t eat richer.

High rates of inflation create a tax on capital that makes

much corporate investment unwise - at least if measured by the

criterion of a positive real investment return to owners. This

“hurdle rate” the return on equity that must be achieved by a

corporation in order to produce any real return for its

individual owners - has increased dramatically in recent years.

The average tax-paying investor is now running up a down

escalator whose pace has accelerated to the point where his

upward progress is nil.

For example, in a world of 12% inflation a business earning

20% on equity (which very few manage consistently to do) and

distributing it all to individuals in the 50% bracket is chewing

up their real capital, not enhancing it. (Half of the 20% will go

for income tax; the remaining 10% leaves the owners of the

business with only 98% of the purchasing power they possessed at

the start of the year - even though they have not spent a penny

of their “earnings”). The investors in this bracket would

actually be better off with a combination of stable prices and

corporate earnings on equity capital of only a few per cent.

Explicit income taxes alone, unaccompanied by any implicit

inflation tax, never can turn a positive corporate return into a

negative owner return. (Even if there were 90% personal income

tax rates on both dividends and capital gains, some real income

would be left for the owner at a zero inflation rate.) But the

inflation tax is not limited by reported income. Inflation rates

not far from those recently experienced can turn the level of

positive returns achieved by a majority of corporations into

negative returns for all owners, including those not required to

pay explicit taxes. (For example, if inflation reached 16%,

owners of the 60% plus of corporate America earning less than

this rate of return would be realizing a negative real return -

even if income taxes on dividends and capital gains were

eliminated.)

Of course, the two forms of taxation co-exist and interact

since explicit taxes are levied on nominal, not real, income.

Thus you pay income taxes on what would be deficits if returns to

stockholders were measured in constant dollars.

At present inflation rates, we believe individual owners in

medium or high tax brackets (as distinguished from tax-free

entities such as pension funds, eleemosynary institutions, etc.)

should expect no real long-term return from the average American

corporation, even though these individuals reinvest the entire

after-tax proceeds from all dividends they receive. The average

return on equity of corporations is fully offset by the

combination of the implicit tax on capital levied by inflation

and the explicit taxes levied both on dividends and gains in

value produced by retained earnings.

As we said last year, Berkshire has no corporate solution to

the problem. (We’ll say it again next year, too.) Inflation does

not improve our return on equity.

Indexing is the insulation that all seek against inflation.

But the great bulk (although there are important exceptions) of

corporate capital is not even partially indexed. Of course,

earnings and dividends per share usually will rise if significant

earnings are “saved” by a corporation; i.e., reinvested instead

of paid as dividends. But that would be true without inflation.

A thrifty wage earner, likewise, could achieve regular annual

increases in his total income without ever getting a pay increase

- if he were willing to take only half of his paycheck in cash

�

(his wage “dividend”) and consistently add the other half (his

“retained earnings”) to a savings account. Neither this high-

saving wage earner nor the stockholder in a high-saving

corporation whose annual dividend rate increases while its rate

of return on equity remains flat is truly indexed.

For capital to be truly indexed, return on equity must rise,

i.e., business earnings consistently must increase in proportion

to the increase in the price level without any need for the

business to add to capital - including working capital -

employed. (Increased earnings produced by increased investment

don’t count.) Only a few businesses come close to exhibiting this

ability. And Berkshire Hathaway isn’t one of them.

We, of course, have a corporate policy of reinvesting

earnings for growth, diversity and strength, which has the

incidental effect of minimizing the current imposition of

explicit taxes on our owners. However, on a day-by-day basis,

you will be subjected to the implicit inflation tax, and when you

wish to transfer your investment in Berkshire into another form

of investment, or into consumption, you also will face explicit

taxes.

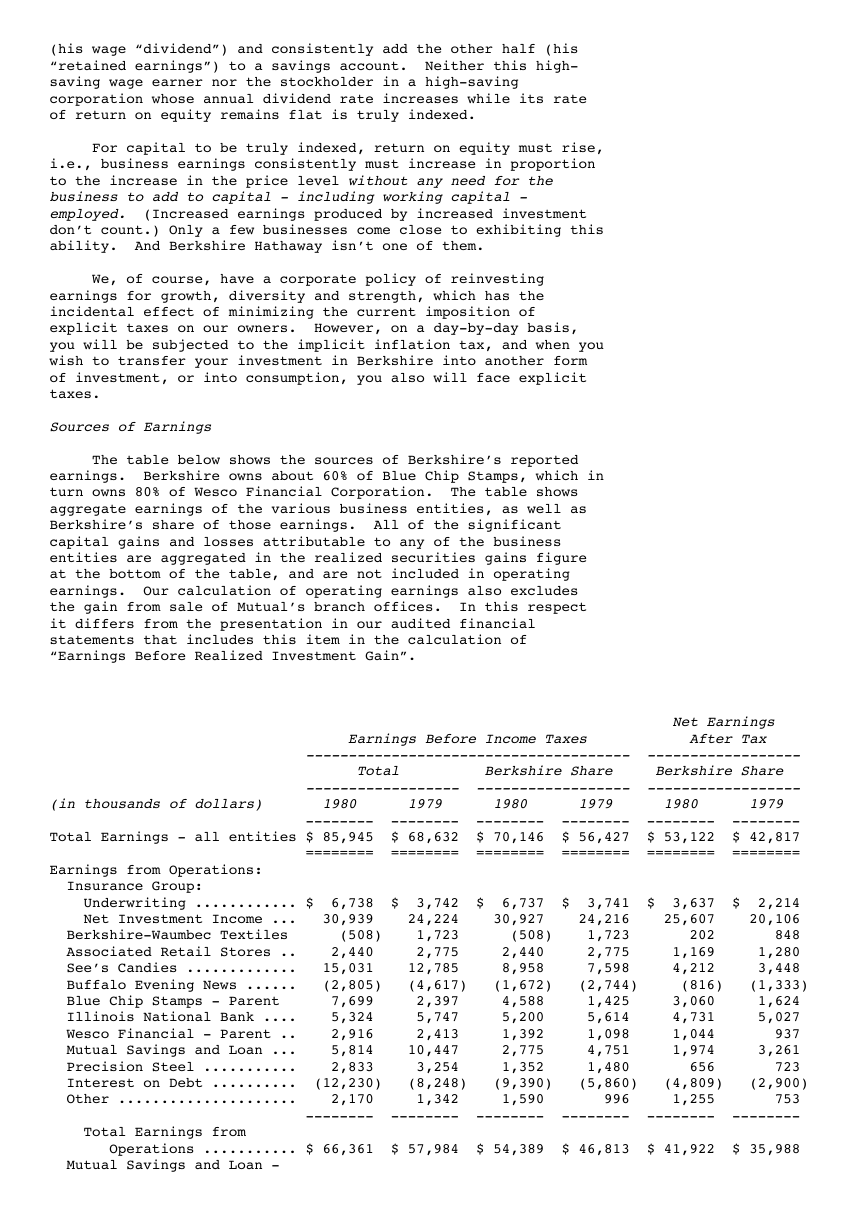

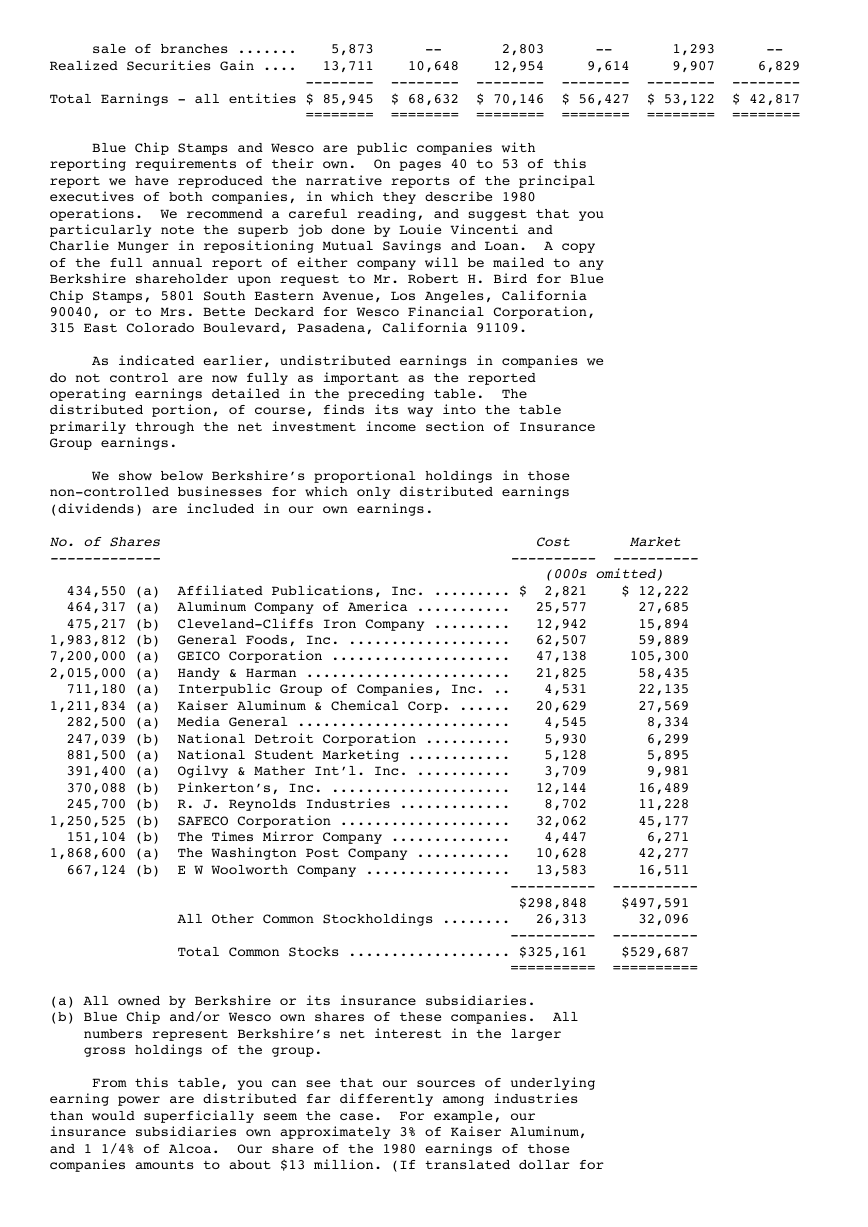

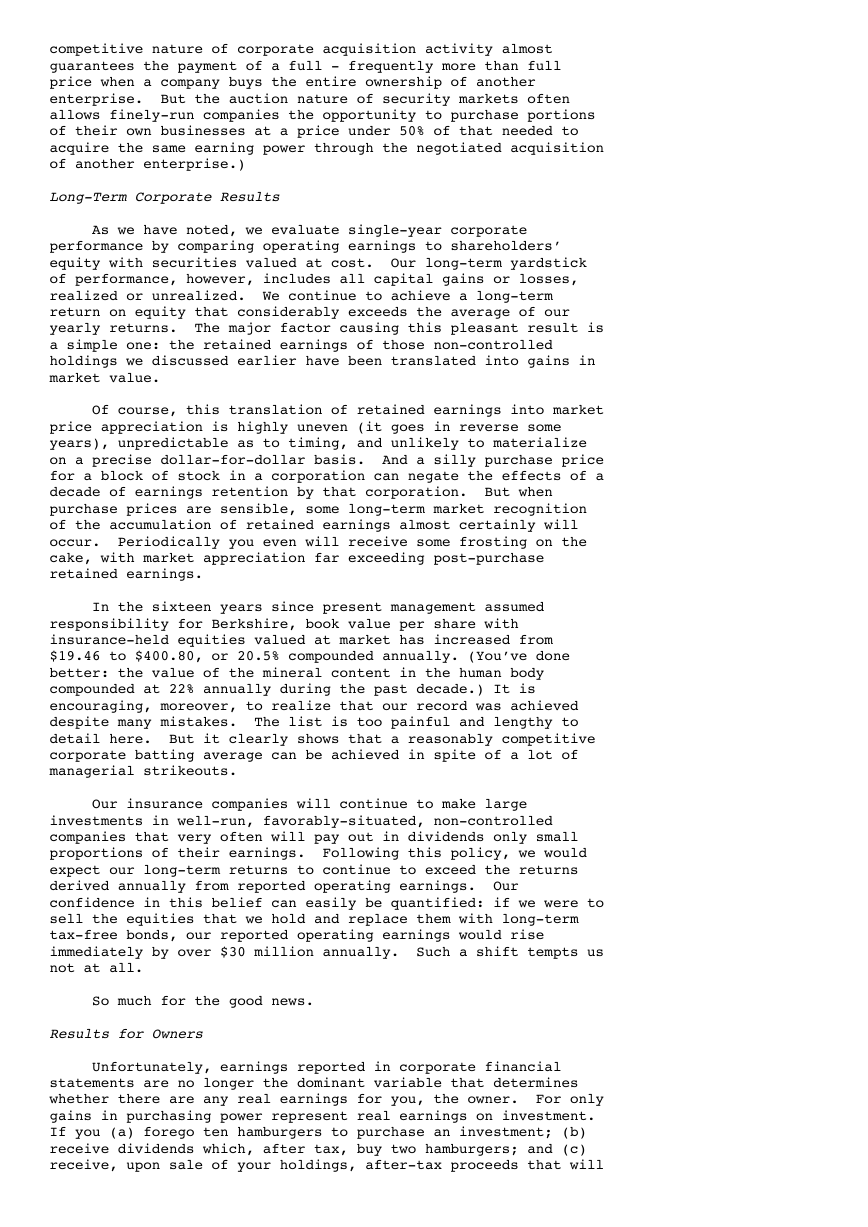

Sources of Earnings

The table below shows the sources of Berkshire’s reported

earnings. Berkshire owns about 60% of Blue Chip Stamps, which in

turn owns 80% of Wesco Financial Corporation. The table shows

aggregate earnings of the various business entities, as well as

Berkshire’s share of those earnings. All of the significant

capital gains and losses attributable to any of the business

entities are aggregated in the realized securities gains figure

at the bottom of the table, and are not included in operating

earnings. Our calculation of operating earnings also excludes

the gain from sale of Mutual’s branch offices. In this respect

it differs from the presentation in our audited financial

statements that includes this item in the calculation of

“Earnings Before Realized Investment Gain”.

Net Earnings

Earnings Before Income Taxes After Tax

-------------------------------------- ------------------

Total Berkshire Share Berkshire Share

------------------ ------------------ ------------------

(in thousands of dollars) 1980 1979 1980 1979 1980 1979

-------- -------- -------- -------- -------- --------

Total Earnings - all entities $ 85,945 $ 68,632 $ 70,146 $ 56,427 $ 53,122 $ 42,817

======== ======== ======== ======== ======== ========

Earnings from Operations:

Insurance Group:

Underwriting ............ $ 6,738 $ 3,742 $ 6,737 $ 3,741 $ 3,637 $ 2,214

Net Investment Income ... 30,939 24,224 30,927 24,216 25,607 20,106

Berkshire-Waumbec Textiles (508) 1,723 (508) 1,723 202 848

Associated Retail Stores .. 2,440 2,775 2,440 2,775 1,169 1,280

See’s Candies ............. 15,031 12,785 8,958 7,598 4,212 3,448

Buffalo Evening News ...... (2,805) (4,617) (1,672) (2,744) (816) (1,333)

Blue Chip Stamps - Parent 7,699 2,397 4,588 1,425 3,060 1,624

Illinois National Bank .... 5,324 5,747 5,200 5,614 4,731 5,027

Wesco Financial - Parent .. 2,916 2,413 1,392 1,098 1,044 937

Mutual Savings and Loan ... 5,814 10,447 2,775 4,751 1,974 3,261

Precision Steel ........... 2,833 3,254 1,352 1,480 656 723

Interest on Debt .......... (12,230) (8,248) (9,390) (5,860) (4,809) (2,900)

Other ..................... 2,170 1,342 1,590 996 1,255 753

-------- -------- -------- -------- -------- --------

Total Earnings from

Operations ........... $ 66,361 $ 57,984 $ 54,389 $ 46,813 $ 41,922 $ 35,988

Mutual Savings and Loan -

�

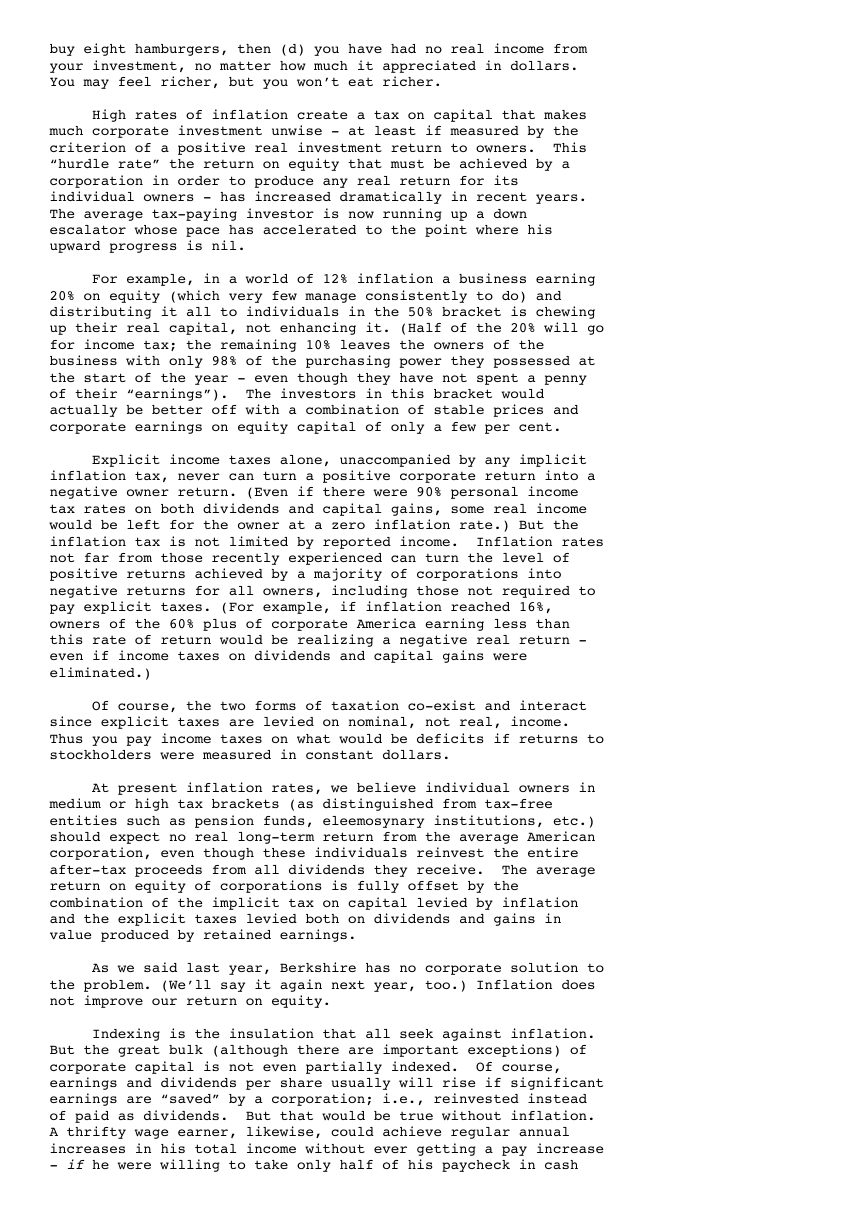

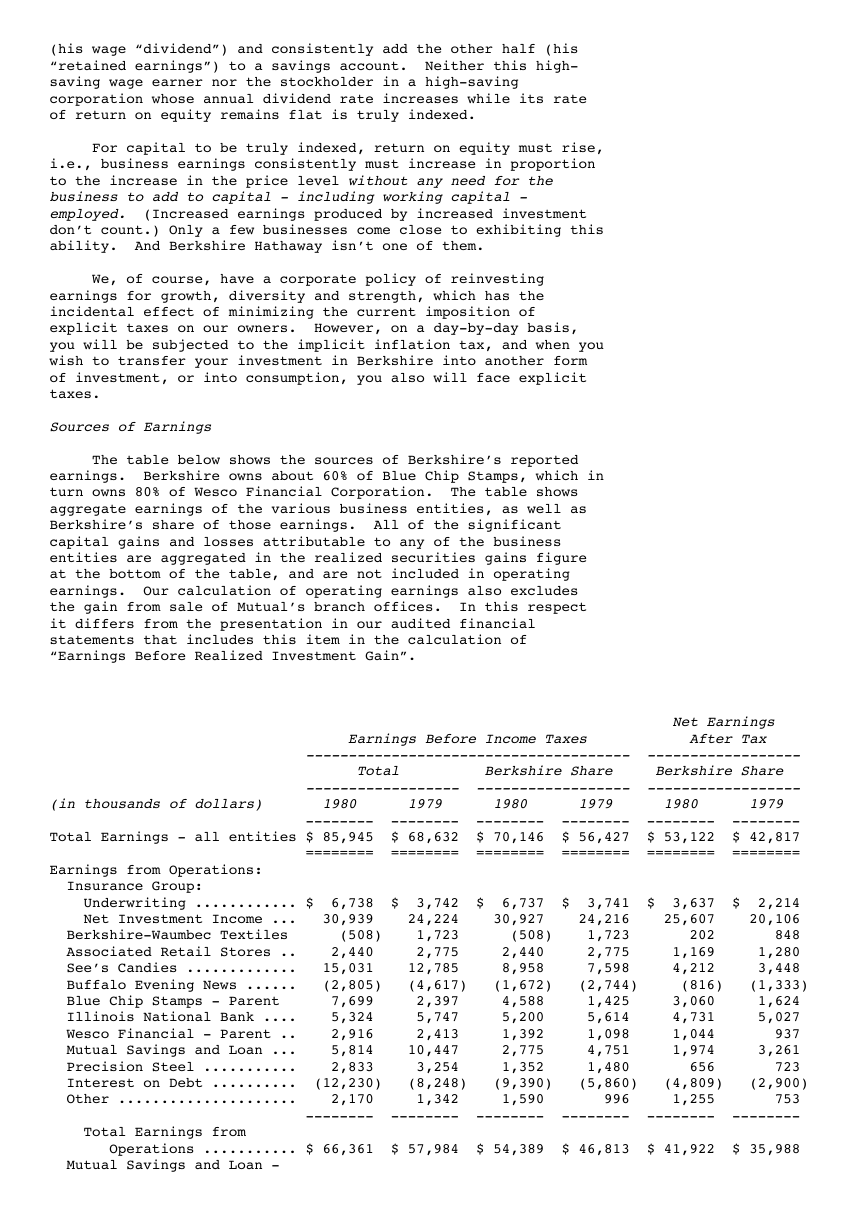

sale of branches ....... 5,873 -- 2,803 -- 1,293 --

Realized Securities Gain .... 13,711 10,648 12,954 9,614 9,907 6,829

-------- -------- -------- -------- -------- --------

Total Earnings - all entities $ 85,945 $ 68,632 $ 70,146 $ 56,427 $ 53,122 $ 42,817

======== ======== ======== ======== ======== ========

Blue Chip Stamps and Wesco are public companies with

reporting requirements of their own. On pages 40 to 53 of this

report we have reproduced the narrative reports of the principal

executives of both companies, in which they describe 1980

operations. We recommend a careful reading, and suggest that you

particularly note the superb job done by Louie Vincenti and

Charlie Munger in repositioning Mutual Savings and Loan. A copy

of the full annual report of either company will be mailed to any

Berkshire shareholder upon request to Mr. Robert H. Bird for Blue

Chip Stamps, 5801 South Eastern Avenue, Los Angeles, California

90040, or to Mrs. Bette Deckard for Wesco Financial Corporation,

315 East Colorado Boulevard, Pasadena, California 91109.

As indicated earlier, undistributed earnings in companies we

do not control are now fully as important as the reported

operating earnings detailed in the preceding table. The

distributed portion, of course, finds its way into the table

primarily through the net investment income section of Insurance

Group earnings.

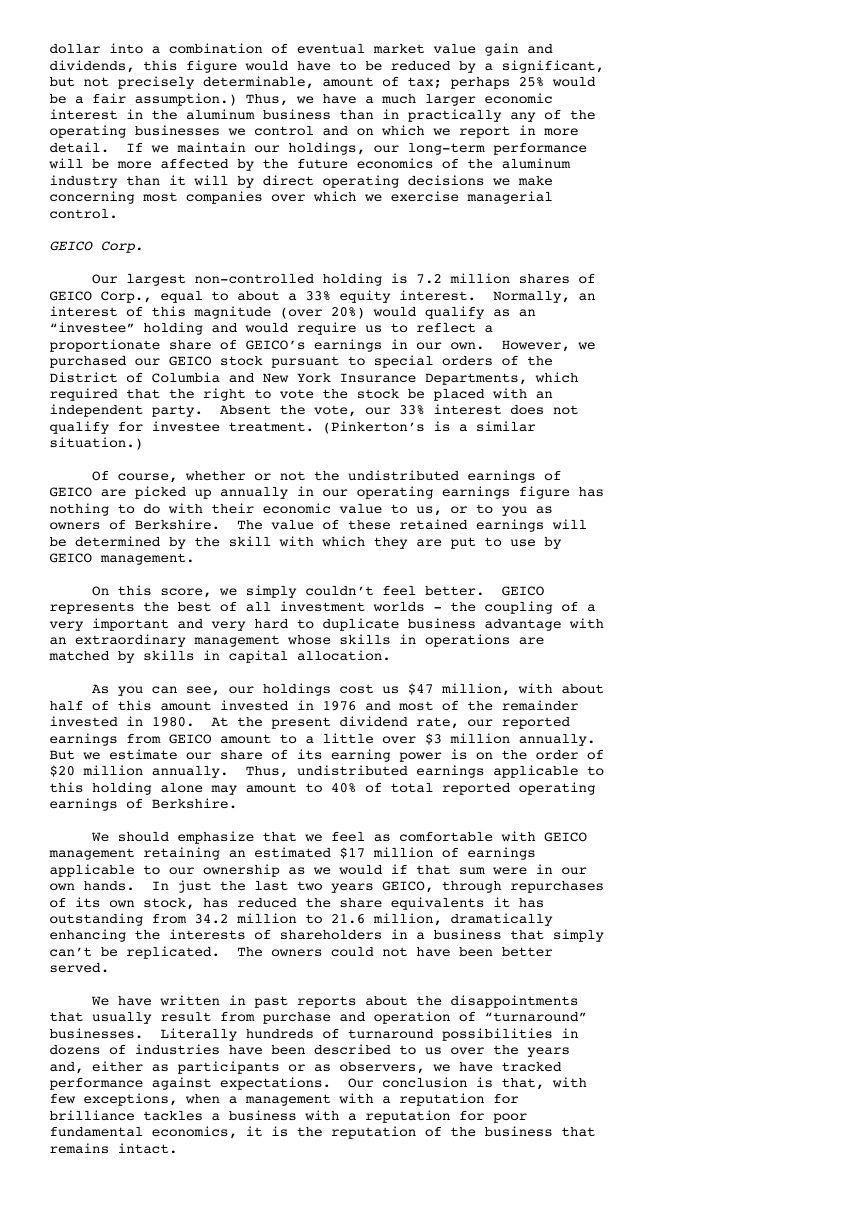

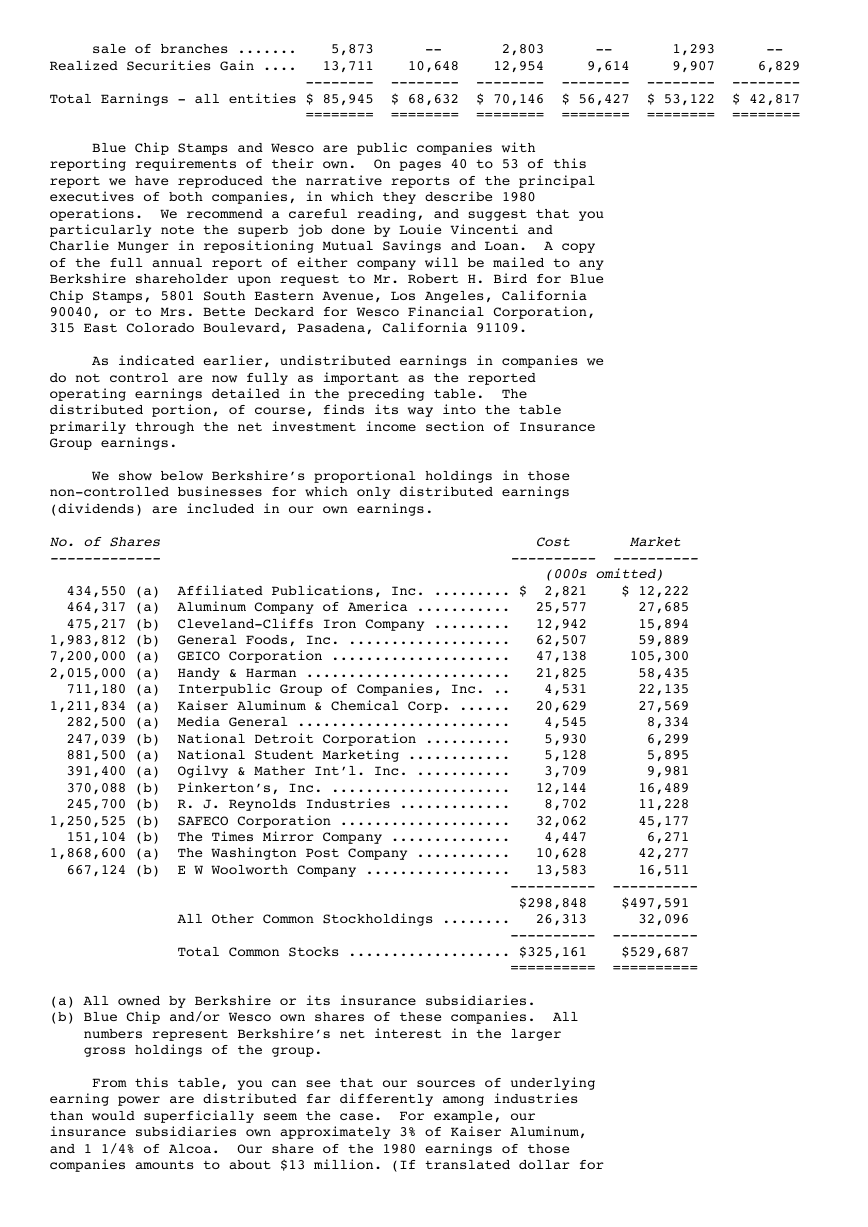

We show below Berkshire’s proportional holdings in those

non-controlled businesses for which only distributed earnings

(dividends) are included in our own earnings.

No. of Shares Cost Market

------------- ---------- ----------

(000s omitted)

434,550 (a) Affiliated Publications, Inc. ......... $ 2,821 $ 12,222

464,317 (a) Aluminum Company of America ........... 25,577 27,685

475,217 (b) Cleveland-Cliffs Iron Company ......... 12,942 15,894

1,983,812 (b) General Foods, Inc. ................... 62,507 59,889

7,200,000 (a) GEICO Corporation ..................... 47,138 105,300

2,015,000 (a) Handy & Harman ........................ 21,825 58,435

711,180 (a) Interpublic Group of Companies, Inc. .. 4,531 22,135

1,211,834 (a) Kaiser Aluminum & Chemical Corp. ...... 20,629 27,569

282,500 (a) Media General ......................... 4,545 8,334

247,039 (b) National Detroit Corporation .......... 5,930 6,299

881,500 (a) National Student Marketing ............ 5,128 5,895

391,400 (a) Ogilvy & Mather Int’l. Inc. ........... 3,709 9,981

370,088 (b) Pinkerton’s, Inc. ..................... 12,144 16,489

245,700 (b) R. J. Reynolds Industries ............. 8,702 11,228

1,250,525 (b) SAFECO Corporation .................... 32,062 45,177

151,104 (b) The Times Mirror Company .............. 4,447 6,271

1,868,600 (a) The Washington Post Company ........... 10,628 42,277

667,124 (b) E W Woolworth Company ................. 13,583 16,511

---------- ----------

$298,848 $497,591

All Other Common Stockholdings ........ 26,313 32,096

---------- ----------

Total Common Stocks ................... $325,161 $529,687

========== ==========

(a) All owned by Berkshire or its insurance subsidiaries.

(b) Blue Chip and/or Wesco own shares of these companies. All

numbers represent Berkshire’s net interest in the larger

gross holdings of the group.

From this table, you can see that our sources of underlying

earning power are distributed far differently among industries

than would superficially seem the case. For example, our

insurance subsidiaries own approximately 3% of Kaiser Aluminum,

and 1 1/4% of Alcoa. Our share of the 1980 earnings of those

companies amounts to about $13 million. (If translated dollar for

�

dollar into a combination of eventual market value gain and

dividends, this figure would have to be reduced by a significant,

but not precisely determinable, amount of tax; perhaps 25% would

be a fair assumption.) Thus, we have a much larger economic

interest in the aluminum business than in practically any of the

operating businesses we control and on which we report in more

detail. If we maintain our holdings, our long-term performance

will be more affected by the future economics of the aluminum

industry than it will by direct operating decisions we make

concerning most companies over which we exercise managerial

control.

GEICO Corp.

Our largest non-controlled holding is 7.2 million shares of

GEICO Corp., equal to about a 33% equity interest. Normally, an

interest of this magnitude (over 20%) would qualify as an

“investee” holding and would require us to reflect a

proportionate share of GEICO’s earnings in our own. However, we

purchased our GEICO stock pursuant to special orders of the

District of Columbia and New York Insurance Departments, which

required that the right to vote the stock be placed with an

independent party. Absent the vote, our 33% interest does not

qualify for investee treatment. (Pinkerton’s is a similar

situation.)

Of course, whether or not the undistributed earnings of

GEICO are picked up annually in our operating earnings figure has

nothing to do with their economic value to us, or to you as

owners of Berkshire. The value of these retained earnings will

be determined by the skill with which they are put to use by

GEICO management.

On this score, we simply couldn’t feel better. GEICO

represents the best of all investment worlds - the coupling of a

very important and very hard to duplicate business advantage with

an extraordinary management whose skills in operations are

matched by skills in capital allocation.

As you can see, our holdings cost us $47 million, with about

half of this amount invested in 1976 and most of the remainder

invested in 1980. At the present dividend rate, our reported

earnings from GEICO amount to a little over $3 million annually.

But we estimate our share of its earning power is on the order of

$20 million annually. Thus, undistributed earnings applicable to

this holding alone may amount to 40% of total reported operating

earnings of Berkshire.

We should emphasize that we feel as comfortable with GEICO

management retaining an estimated $17 million of earnings

applicable to our ownership as we would if that sum were in our

own hands. In just the last two years GEICO, through repurchases

of its own stock, has reduced the share equivalents it has

outstanding from 34.2 million to 21.6 million, dramatically

enhancing the interests of shareholders in a business that simply

can’t be replicated. The owners could not have been better

served.

We have written in past reports about the disappointments

that usually result from purchase and operation of “turnaround”

businesses. Literally hundreds of turnaround possibilities in

dozens of industries have been described to us over the years

and, either as participants or as observers, we have tracked

performance against expectations. Our conclusion is that, with

few exceptions, when a management with a reputation for

brilliance tackles a business with a reputation for poor

fundamental economics, it is the reputation of the business that

remains intact.

�

GEICO may appear to be an exception, having been turned

around from the very edge of bankruptcy in 1976. It certainly is

true that managerial brilliance was needed for its resuscitation,

and that Jack Byrne, upon arrival in that year, supplied that

ingredient in abundance.

But it also is true that the fundamental business advantage

that GEICO had enjoyed - an advantage that previously had

produced staggering success - was still intact within the

company, although submerged in a sea of financial and operating

troubles.

GEICO was designed to be the low-cost operation in an

enormous marketplace (auto insurance) populated largely by

companies whose marketing structures restricted adaptation. Run

as designed, it could offer unusual value to its customers while

earning unusual returns for itself. For decades it had been run

in just this manner. Its troubles in the mid-70s were not

produced by any diminution or disappearance of this essential

economic advantage.

GEICO’s problems at that time put it in a position analogous

to that of American Express in 1964 following the salad oil

scandal. Both were one-of-a-kind companies, temporarily reeling

from the effects of a fiscal blow that did not destroy their

exceptional underlying economics. The GEICO and American Express

situations, extraordinary business franchises with a localized

excisable cancer (needing, to be sure, a skilled surgeon), should

be distinguished from the true “turnaround” situation in which

the managers expect - and need - to pull off a corporate

Pygmalion.

Whatever the appellation, we are delighted with our GEICO

holding which, as noted, cost us $47 million. To buy a similar

$20 million of earning power in a business with first-class

economic characteristics and bright prospects would cost a

minimum of $200 million (much more in some industries) if it had

to be accomplished through negotiated purchase of an entire

company. A 100% interest of that kind gives the owner the

options of leveraging the purchase, changing managements,

directing cash flow, and selling the business. It may also

provide some excitement around corporate headquarters (less

frequently mentioned).

We find it perfectly satisfying that the nature of our

insurance business dictates we buy many minority portions of

already well-run businesses (at prices far below our share of the

total value of the entire business) that do not need management

change, re-direction of cash flow, or sale. There aren’t many

Jack Byrnes in the managerial world, or GEICOs in the business

world. What could be better than buying into a partnership with

both of them?

Insurance Industry Conditions

The insurance industry’s underwriting picture continues to

unfold about as we anticipated, with the combined ratio (see

definition on page 37) rising from 100.6 in 1979 to an estimated

103.5 in 1980. It is virtually certain that this trend will

continue and that industry underwriting losses will mount,

significantly and progressively, in 1981 and 1982. To understand

why, we recommend that you read the excellent analysis of

property-casualty competitive dynamics done by Barbara Stewart of

Chubb Corp. in an October 1980 paper. (Chubb’s annual report

consistently presents the most insightful, candid and well-

written discussion of industry conditions; you should get on the

company’s mailing list.) Mrs. Stewart’s analysis may not be

cheerful, but we think it is very likely to be accurate.

�