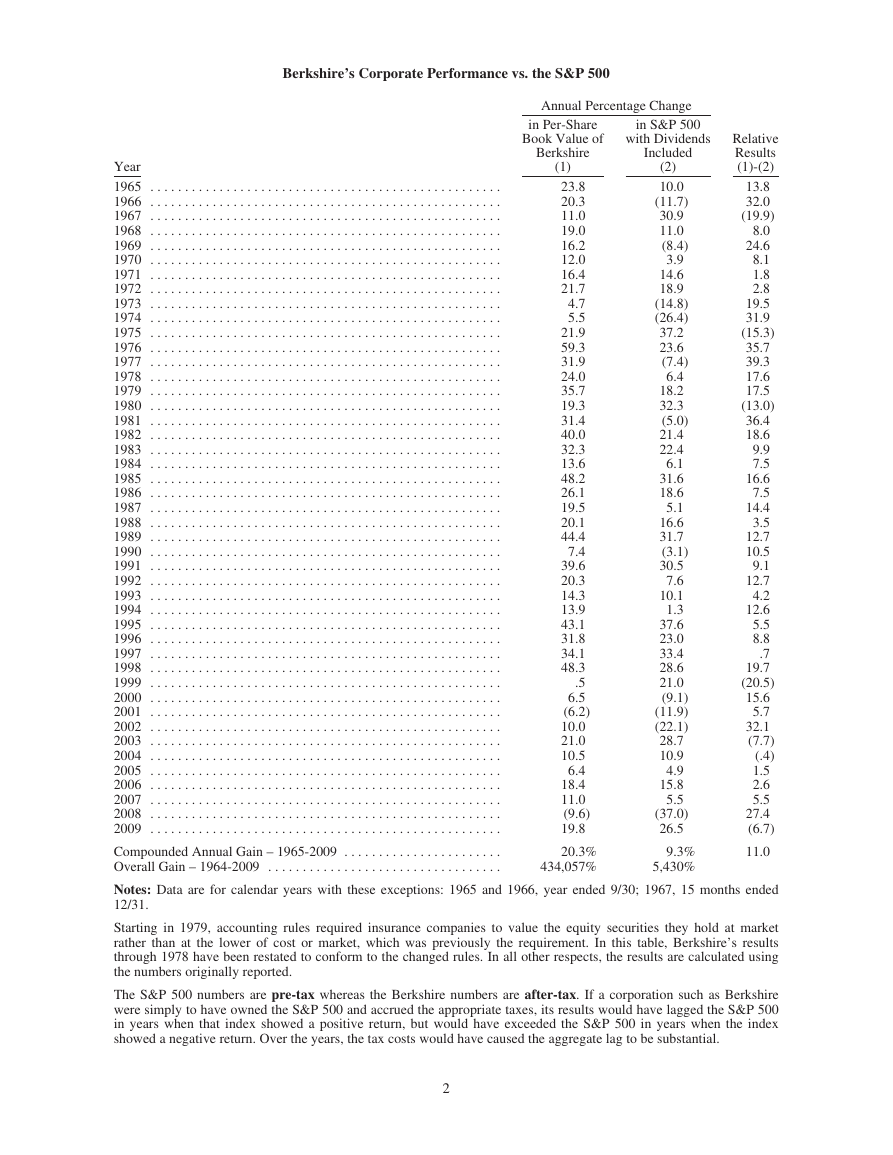

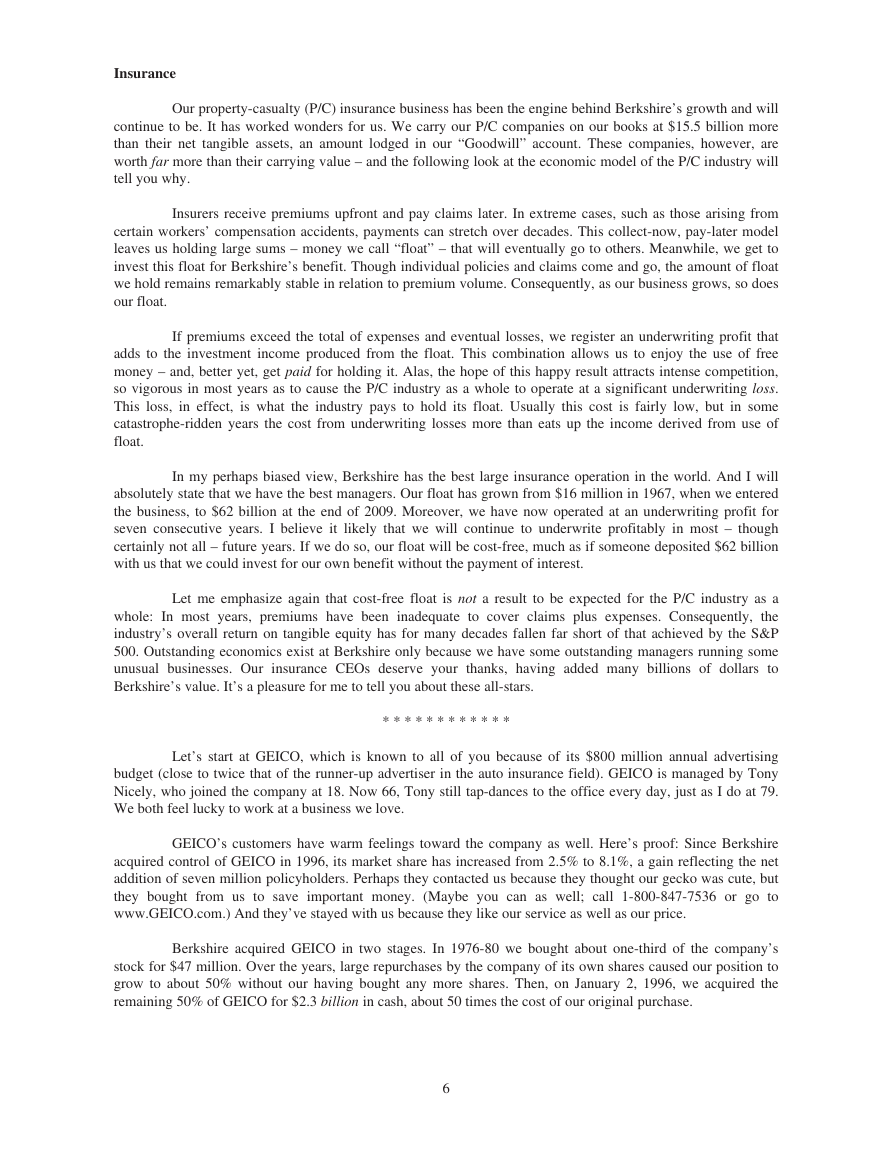

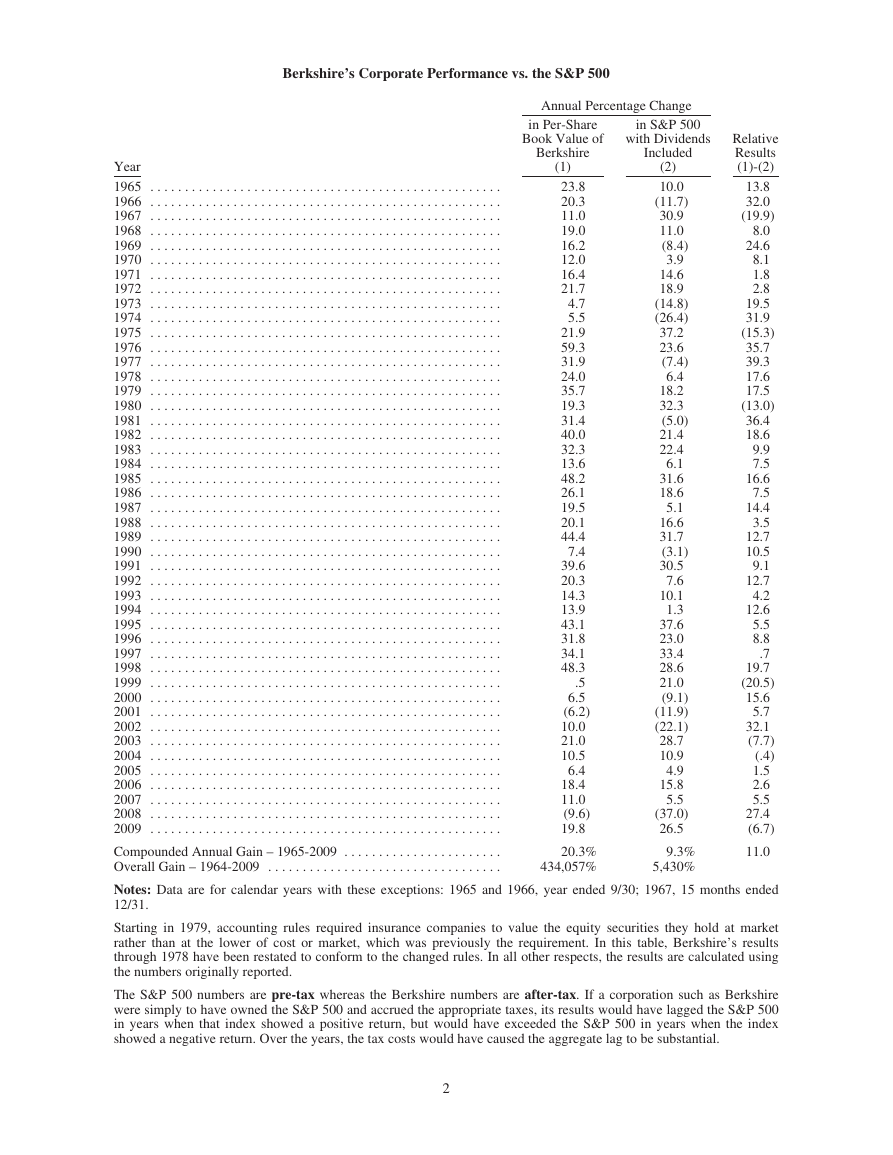

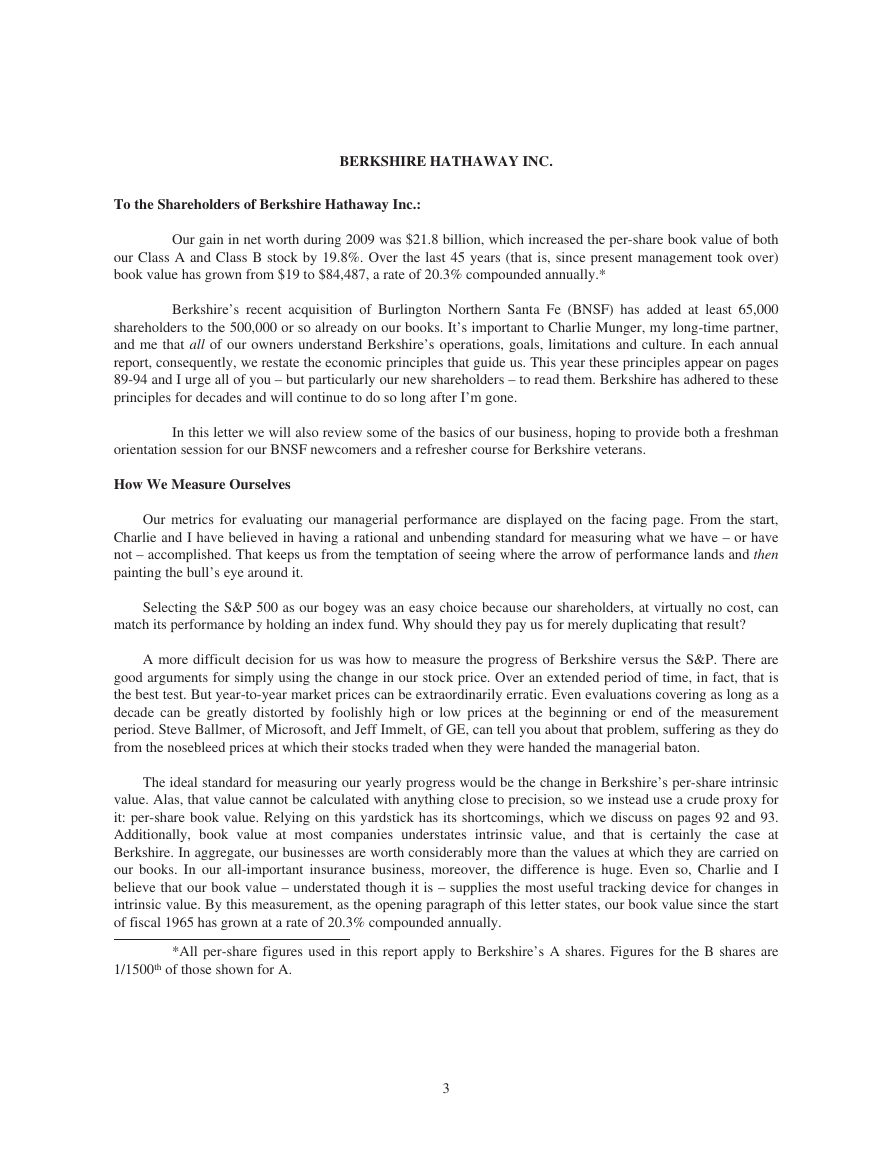

Berkshire’s Corporate Performance vs. the S&P 500

Annual Percentage Change

Year

1965 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1966 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1967 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1968 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1969 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1970 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1971 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1972 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1973 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1974 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1975 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1976 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1977 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1978 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1979 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1980 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1981 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1982 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1983 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1984 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1985 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1986 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1987 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1988 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1989 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1990 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1991 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1992 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1993 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1994 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1995 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1996 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1997 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1998 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1999 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2002 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2003 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2004 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

in Per-Share

Book Value of

Berkshire

(1)

23.8

20.3

11.0

19.0

16.2

12.0

16.4

21.7

4.7

5.5

21.9

59.3

31.9

24.0

35.7

19.3

31.4

40.0

32.3

13.6

48.2

26.1

19.5

20.1

44.4

7.4

39.6

20.3

14.3

13.9

43.1

31.8

34.1

48.3

.5

6.5

(6.2)

10.0

21.0

10.5

6.4

18.4

11.0

(9.6)

19.8

in S&P 500

with Dividends

Included

(2)

10.0

(11.7)

30.9

11.0

(8.4)

3.9

14.6

18.9

(14.8)

(26.4)

37.2

23.6

(7.4)

6.4

18.2

32.3

(5.0)

21.4

22.4

6.1

31.6

18.6

5.1

16.6

31.7

(3.1)

30.5

7.6

10.1

1.3

37.6

23.0

33.4

28.6

21.0

(9.1)

(11.9)

(22.1)

28.7

10.9

4.9

15.8

5.5

(37.0)

26.5

Relative

Results

(1)-(2)

13.8

32.0

(19.9)

8.0

24.6

8.1

1.8

2.8

19.5

31.9

(15.3)

35.7

39.3

17.6

17.5

(13.0)

36.4

18.6

9.9

7.5

16.6

7.5

14.4

3.5

12.7

10.5

9.1

12.7

4.2

12.6

5.5

8.8

.7

19.7

(20.5)

15.6

5.7

32.1

(7.7)

(.4)

1.5

2.6

5.5

27.4

(6.7)

Compounded Annual Gain – 1965-2009 . . . . . . . . . . . . . . . . . . . . . . .

Overall Gain – 1964-2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Notes: Data are for calendar years with these exceptions: 1965 and 1966, year ended 9/30; 1967, 15 months ended

12/31.

20.3%

434,057%

9.3%

5,430%

11.0

Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market

rather than at the lower of cost or market, which was previously the requirement. In this table, Berkshire’s results

through 1978 have been restated to conform to the changed rules. In all other respects, the results are calculated using

the numbers originally reported.

The S&P 500 numbers are pre-tax whereas the Berkshire numbers are after-tax. If a corporation such as Berkshire

were simply to have owned the S&P 500 and accrued the appropriate taxes, its results would have lagged the S&P 500

in years when that index showed a positive return, but would have exceeded the S&P 500 in years when the index

showed a negative return. Over the years, the tax costs would have caused the aggregate lag to be substantial.

2

�

BERKSHIRE HATHAWAY INC.

To the Shareholders of Berkshire Hathaway Inc.:

Our gain in net worth during 2009 was $21.8 billion, which increased the per-share book value of both

our Class A and Class B stock by 19.8%. Over the last 45 years (that is, since present management took over)

book value has grown from $19 to $84,487, a rate of 20.3% compounded annually.*

Berkshire’s recent acquisition of Burlington Northern Santa Fe (BNSF) has added at least 65,000

shareholders to the 500,000 or so already on our books. It’s important to Charlie Munger, my long-time partner,

and me that all of our owners understand Berkshire’s operations, goals, limitations and culture. In each annual

report, consequently, we restate the economic principles that guide us. This year these principles appear on pages

89-94 and I urge all of you – but particularly our new shareholders – to read them. Berkshire has adhered to these

principles for decades and will continue to do so long after I’m gone.

In this letter we will also review some of the basics of our business, hoping to provide both a freshman

orientation session for our BNSF newcomers and a refresher course for Berkshire veterans.

How We Measure Ourselves

Our metrics for evaluating our managerial performance are displayed on the facing page. From the start,

Charlie and I have believed in having a rational and unbending standard for measuring what we have – or have

not – accomplished. That keeps us from the temptation of seeing where the arrow of performance lands and then

painting the bull’s eye around it.

Selecting the S&P 500 as our bogey was an easy choice because our shareholders, at virtually no cost, can

match its performance by holding an index fund. Why should they pay us for merely duplicating that result?

A more difficult decision for us was how to measure the progress of Berkshire versus the S&P. There are

good arguments for simply using the change in our stock price. Over an extended period of time, in fact, that is

the best test. But year-to-year market prices can be extraordinarily erratic. Even evaluations covering as long as a

decade can be greatly distorted by foolishly high or low prices at the beginning or end of the measurement

period. Steve Ballmer, of Microsoft, and Jeff Immelt, of GE, can tell you about that problem, suffering as they do

from the nosebleed prices at which their stocks traded when they were handed the managerial baton.

The ideal standard for measuring our yearly progress would be the change in Berkshire’s per-share intrinsic

value. Alas, that value cannot be calculated with anything close to precision, so we instead use a crude proxy for

it: per-share book value. Relying on this yardstick has its shortcomings, which we discuss on pages 92 and 93.

Additionally, book value at most companies understates intrinsic value, and that is certainly the case at

Berkshire. In aggregate, our businesses are worth considerably more than the values at which they are carried on

our books. In our all-important insurance business, moreover, the difference is huge. Even so, Charlie and I

believe that our book value – understated though it is – supplies the most useful tracking device for changes in

intrinsic value. By this measurement, as the opening paragraph of this letter states, our book value since the start

of fiscal 1965 has grown at a rate of 20.3% compounded annually.

*All per-share figures used in this report apply to Berkshire’s A shares. Figures for the B shares are

1/1500th of those shown for A.

3

�

We should note that had we instead chosen market prices as our yardstick, Berkshire’s results would

look better, showing a gain since the start of fiscal 1965 of 22% compounded annually. Surprisingly, this modest

difference in annual compounding rate leads to an 801,516% market-value gain for the entire 45-year period

compared to the book-value gain of 434,057% (shown on page 2). Our market gain is better because in 1965

Berkshire shares sold at an appropriate discount to the book value of its underearning textile assets, whereas

today Berkshire shares regularly sell at a premium to the accounting values of its first-class businesses.

Summed up, the table on page 2 conveys three messages, two positive and one hugely negative. First,

we have never had any five-year period beginning with 1965-69 and ending with 2005-09 – and there have been

41 of these – during which our gain in book value did not exceed the S&P’s gain. Second, though we have lagged

the S&P in some years that were positive for the market, we have consistently done better than the S&P in the

eleven years during which it delivered negative results. In other words, our defense has been better than our

offense, and that’s likely to continue.

The big minus is that our performance advantage has shrunk dramatically as our size has grown, an

unpleasant trend that is certain to continue. To be sure, Berkshire has many outstanding businesses and a cadre of

truly great managers, operating within an unusual corporate culture that lets them maximize their talents. Charlie

and I believe these factors will continue to produce better-than-average results over time. But huge sums forge

their own anchor and our future advantage, if any, will be a small fraction of our historical edge.

What We Don’t Do

Long ago, Charlie laid out his strongest ambition: “All I want to know is where I’m going to die, so I’ll

never go there.” That bit of wisdom was inspired by Jacobi, the great Prussian mathematician, who counseled

“Invert, always invert” as an aid to solving difficult problems. (I can report as well that this inversion approach

works on a less lofty level: Sing a country song in reverse, and you will quickly recover your car, house and

wife.)

Here are a few examples of how we apply Charlie’s thinking at Berkshire:

• Charlie and I avoid businesses whose futures we can’t evaluate, no matter how exciting their

products may be. In the past, it required no brilliance for people to foresee the fabulous growth

that awaited such industries as autos (in 1910), aircraft (in 1930) and television sets (in 1950). But

the future then also included competitive dynamics that would decimate almost all of the

companies entering those industries. Even the survivors tended to come away bleeding.

Just because Charlie and I can clearly see dramatic growth ahead for an industry does not mean

we can judge what its profit margins and returns on capital will be as a host of competitors battle

for supremacy. At Berkshire we will stick with businesses whose profit picture for decades to

come seems reasonably predictable. Even then, we will make plenty of mistakes.

• We will never become dependent on the kindness of strangers. Too-big-to-fail is not a fallback

position at Berkshire. Instead, we will always arrange our affairs so that any requirements for cash

we may conceivably have will be dwarfed by our own liquidity. Moreover, that liquidity will be

constantly refreshed by a gusher of earnings from our many and diverse businesses.

When the financial system went into cardiac arrest in September 2008, Berkshire was a supplier

of liquidity and capital to the system, not a supplicant. At the very peak of the crisis, we poured

$15.5 billion into a business world that could otherwise look only to the federal government for

help. Of that, $9 billion went to bolster capital at three highly-regarded and previously-secure

American businesses that needed – without delay – our tangible vote of confidence. The remaining

$6.5 billion satisfied our commitment to help fund the purchase of Wrigley, a deal that was

completed without pause while, elsewhere, panic reigned.

4

�

We pay a steep price to maintain our premier financial strength. The $20 billion-plus of cash-

equivalent assets that we customarily hold is earning a pittance at present. But we sleep well.

• We tend to let our many subsidiaries operate on their own, without our supervising and

monitoring them to any degree. That means we are sometimes late in spotting management

problems and that both operating and capital decisions are occasionally made with which Charlie

and I would have disagreed had we been consulted. Most of our managers, however, use the

independence we grant them magnificently, rewarding our confidence by maintaining an owner-

oriented attitude that is invaluable and too seldom found in huge organizations. We would rather

suffer the visible costs of a few bad decisions than incur the many invisible costs that come from

decisions made too slowly – or not at all – because of a stifling bureaucracy.

With our acquisition of BNSF, we now have about 257,000 employees and literally hundreds of

different operating units. We hope to have many more of each. But we will never allow Berkshire

to become some monolith that is overrun with committees, budget presentations and multiple

layers of management. Instead, we plan to operate as a collection of separately-managed medium-

sized and large businesses, most of whose decision-making occurs at the operating level. Charlie

and I will limit ourselves to allocating capital, controlling enterprise risk, choosing managers and

setting their compensation.

• We make no attempt to woo Wall Street. Investors who buy and sell based upon media or analyst

commentary are not for us. Instead we want partners who join us at Berkshire because they wish

to make a long-term investment in a business they themselves understand and because it’s one that

follows policies with which they concur. If Charlie and I were to go into a small venture with a

few partners, we would seek individuals in sync with us, knowing that common goals and a shared

destiny make for a happy business “marriage” between owners and managers. Scaling up to giant

size doesn’t change that truth.

To build a compatible shareholder population, we try to communicate with our owners directly

and informatively. Our goal is to tell you what we would like to know if our positions were

reversed. Additionally, we try to post our quarterly and annual financial information on the

Internet early on weekends, thereby giving you and other investors plenty of time during a

non-trading period to digest just what has happened at our multi-faceted enterprise. (Occasionally,

SEC deadlines force a non-Friday disclosure.) These matters simply can’t be adequately

summarized in a few paragraphs, nor do they lend themselves to the kind of catchy headline that

journalists sometimes seek.

Last year we saw, in one instance, how sound-bite reporting can go wrong. Among the 12,830

words in the annual letter was this sentence: “We are certain, for example, that the economy will

be in shambles throughout 2009 – and probably well beyond – but that conclusion does not tell us

whether the market will rise or fall.” Many news organizations reported – indeed, blared – the first

part of the sentence while making no mention whatsoever of its ending. I regard this as terrible

journalism: Misinformed readers or viewers may well have thought that Charlie and I were

forecasting bad things for the stock market, though we had not only in that sentence, but also

elsewhere, made it clear we weren’t predicting the market at all. Any investors who were misled

by the sensationalists paid a big price: The Dow closed the day of the letter at 7,063 and finished

the year at 10,428.

Given a few experiences we’ve had like that, you can understand why I prefer that our

communications with you remain as direct and unabridged as possible.

* * * * * * * * * * * *

Let’s move to the specifics of Berkshire’s operations. We have four major operating sectors, each

differing from the others in balance sheet and income account characteristics. Therefore, lumping them together,

as is standard in financial statements, impedes analysis. So we’ll present them as four separate businesses, which

is how Charlie and I view them.

5

�

Insurance

Our property-casualty (P/C) insurance business has been the engine behind Berkshire’s growth and will

continue to be. It has worked wonders for us. We carry our P/C companies on our books at $15.5 billion more

than their net tangible assets, an amount lodged in our “Goodwill” account. These companies, however, are

worth far more than their carrying value – and the following look at the economic model of the P/C industry will

tell you why.

Insurers receive premiums upfront and pay claims later. In extreme cases, such as those arising from

certain workers’ compensation accidents, payments can stretch over decades. This collect-now, pay-later model

leaves us holding large sums – money we call “float” – that will eventually go to others. Meanwhile, we get to

invest this float for Berkshire’s benefit. Though individual policies and claims come and go, the amount of float

we hold remains remarkably stable in relation to premium volume. Consequently, as our business grows, so does

our float.

If premiums exceed the total of expenses and eventual losses, we register an underwriting profit that

adds to the investment income produced from the float. This combination allows us to enjoy the use of free

money – and, better yet, get paid for holding it. Alas, the hope of this happy result attracts intense competition,

so vigorous in most years as to cause the P/C industry as a whole to operate at a significant underwriting loss.

This loss, in effect, is what the industry pays to hold its float. Usually this cost is fairly low, but in some

catastrophe-ridden years the cost from underwriting losses more than eats up the income derived from use of

float.

In my perhaps biased view, Berkshire has the best large insurance operation in the world. And I will

absolutely state that we have the best managers. Our float has grown from $16 million in 1967, when we entered

the business, to $62 billion at the end of 2009. Moreover, we have now operated at an underwriting profit for

seven consecutive years. I believe it likely that we will continue to underwrite profitably in most – though

certainly not all – future years. If we do so, our float will be cost-free, much as if someone deposited $62 billion

with us that we could invest for our own benefit without the payment of interest.

Let me emphasize again that cost-free float is not a result to be expected for the P/C industry as a

whole: In most years, premiums have been inadequate to cover claims plus expenses. Consequently, the

industry’s overall return on tangible equity has for many decades fallen far short of that achieved by the S&P

500. Outstanding economics exist at Berkshire only because we have some outstanding managers running some

unusual businesses. Our insurance CEOs deserve your thanks, having added many billions of dollars to

Berkshire’s value. It’s a pleasure for me to tell you about these all-stars.

* * * * * * * * * * * *

Let’s start at GEICO, which is known to all of you because of its $800 million annual advertising

budget (close to twice that of the runner-up advertiser in the auto insurance field). GEICO is managed by Tony

Nicely, who joined the company at 18. Now 66, Tony still tap-dances to the office every day, just as I do at 79.

We both feel lucky to work at a business we love.

GEICO’s customers have warm feelings toward the company as well. Here’s proof: Since Berkshire

acquired control of GEICO in 1996, its market share has increased from 2.5% to 8.1%, a gain reflecting the net

addition of seven million policyholders. Perhaps they contacted us because they thought our gecko was cute, but

they bought from us to save important money. (Maybe you can as well; call 1-800-847-7536 or go to

www.GEICO.com.) And they’ve stayed with us because they like our service as well as our price.

Berkshire acquired GEICO in two stages. In 1976-80 we bought about one-third of the company’s

stock for $47 million. Over the years, large repurchases by the company of its own shares caused our position to

grow to about 50% without our having bought any more shares. Then, on January 2, 1996, we acquired the

remaining 50% of GEICO for $2.3 billion in cash, about 50 times the cost of our original purchase.

6

�

An old Wall Street joke gets close to our experience:

Customer:

Thanks for putting me in XYZ stock at 5. I hear it’s up to 18.

Broker:

Yes, and that’s just the beginning. In fact, the company is doing so well now,

that it’s an even better buy at 18 than it was when you made your purchase.

Customer:

Damn, I knew I should have waited.

GEICO’s growth may slow in 2010. U.S. vehicle registrations are actually down because of slumping

auto sales. Moreover, high unemployment is causing a growing number of drivers to go uninsured. (That’s illegal

almost everywhere, but if you’ve lost your job and still want to drive . . .) Our “low-cost producer” status,

however, is sure to give us significant gains in the future. In 1995, GEICO was the country’s sixth largest auto

insurer; now we are number three. The company’s float has grown from $2.7 billion to $9.6 billion. Equally

important, GEICO has operated at an underwriting profit in 13 of the 14 years Berkshire has owned it.

I became excited about GEICO in January 1951, when I first visited the company as a 20-year-old

student. Thanks to Tony, I’m even more excited today.

A hugely important event in Berkshire’s history occurred on a Saturday in 1985. Ajit Jain came into

our office in Omaha – and I immediately knew we had found a superstar. (He had been discovered by Mike

Goldberg, now elevated to St. Mike.)

* * * * * * * * * * * *

We immediately put Ajit in charge of National Indemnity’s small and struggling reinsurance operation.

Over the years, he has built this business into a one-of-a-kind giant in the insurance world.

Staffed today by only 30 people, Ajit’s operation has set records for transaction size in several areas of

insurance. Ajit writes billion-dollar limits – and then keeps every dime of the risk instead of laying it off with

other insurers. Three years ago, he took over huge liabilities from Lloyds, allowing it to clean up its relationship

with 27,972 participants (“names”) who had written problem-ridden policies that at one point threatened the

survival of this 322-year-old institution. The premium for that single contract was $7.1 billion. During 2009, he

negotiated a life reinsurance contract that could produce $50 billion of premium for us over the next 50 or so

years.

Ajit’s business is just the opposite of GEICO’s. At that company, we have millions of small policies

that largely renew year after year. Ajit writes relatively few policies, and the mix changes significantly from year

to year. Throughout the world, he is known as the man to call when something both very large and unusual needs

to be insured.

If Charlie, I and Ajit are ever in a sinking boat – and you can only save one of us – swim to Ajit.

Our third insurance powerhouse is General Re. Some years back this operation was troubled; now it is

a gleaming jewel in our insurance crown.

* * * * * * * * * * * *

Under the leadership of Tad Montross, General Re had an outstanding underwriting year in 2009, while

also delivering us unusually large amounts of float per dollar of premium volume. Alongside General Re’s P/C

business, Tad and his associates have developed a major life reinsurance operation that has grown increasingly

valuable.

Last year General Re finally attained 100% ownership of Cologne Re, which since 1995 has been a

key – though only partially-owned – part of our presence around the world. Tad and I will be visiting Cologne in

September to thank its managers for their important contribution to Berkshire.

7

�

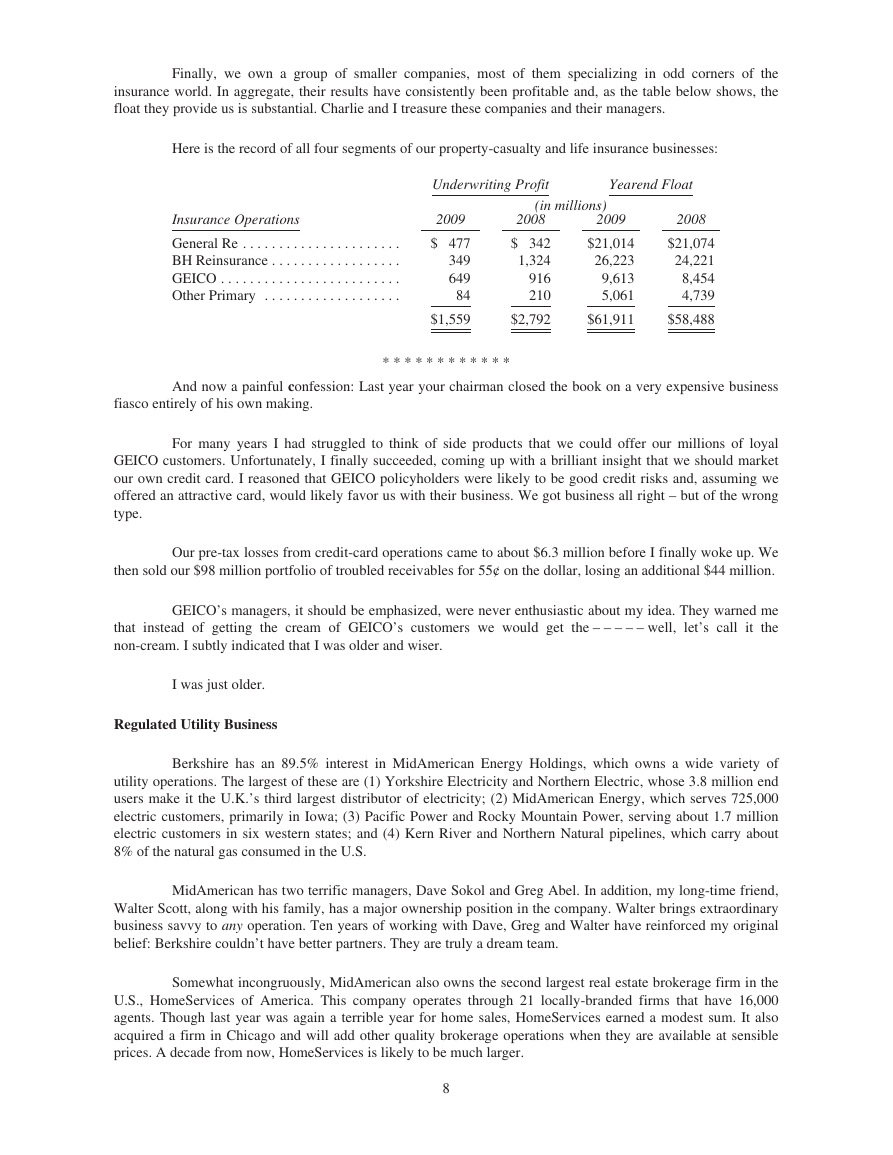

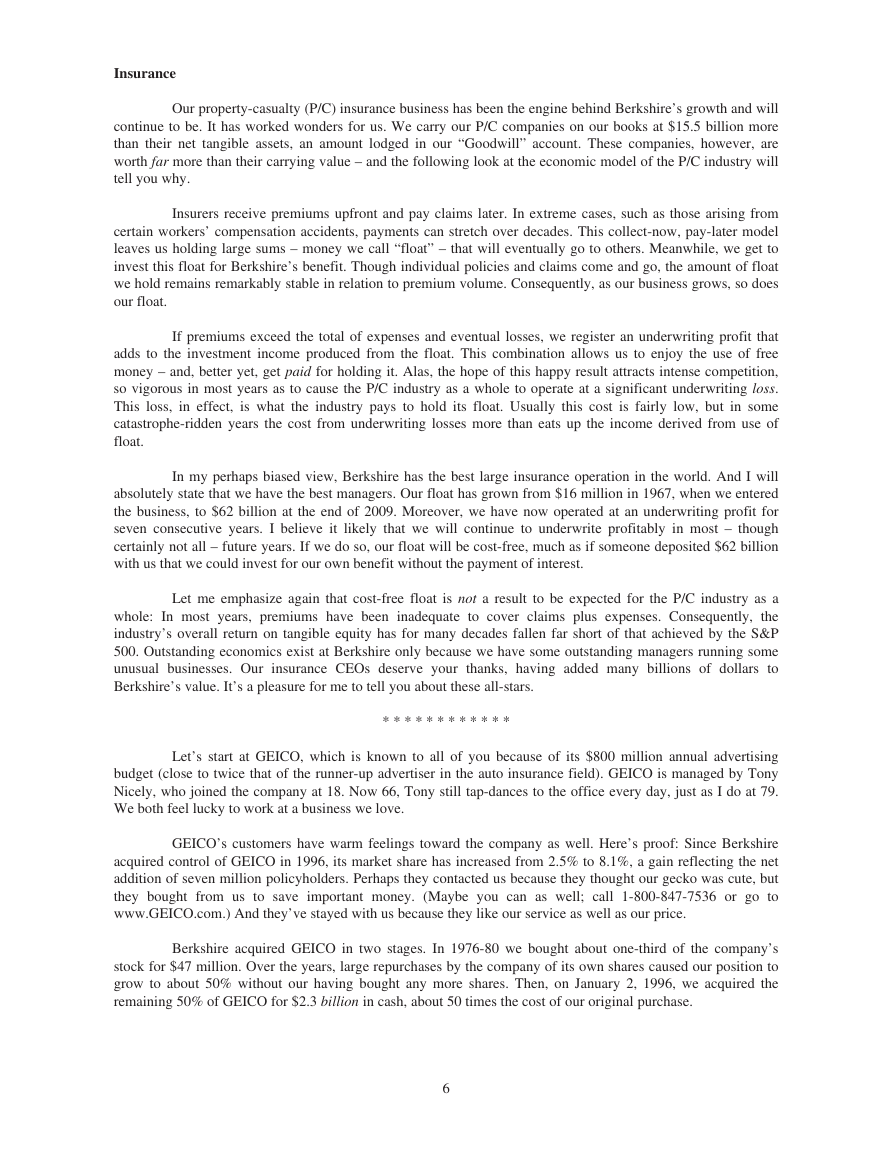

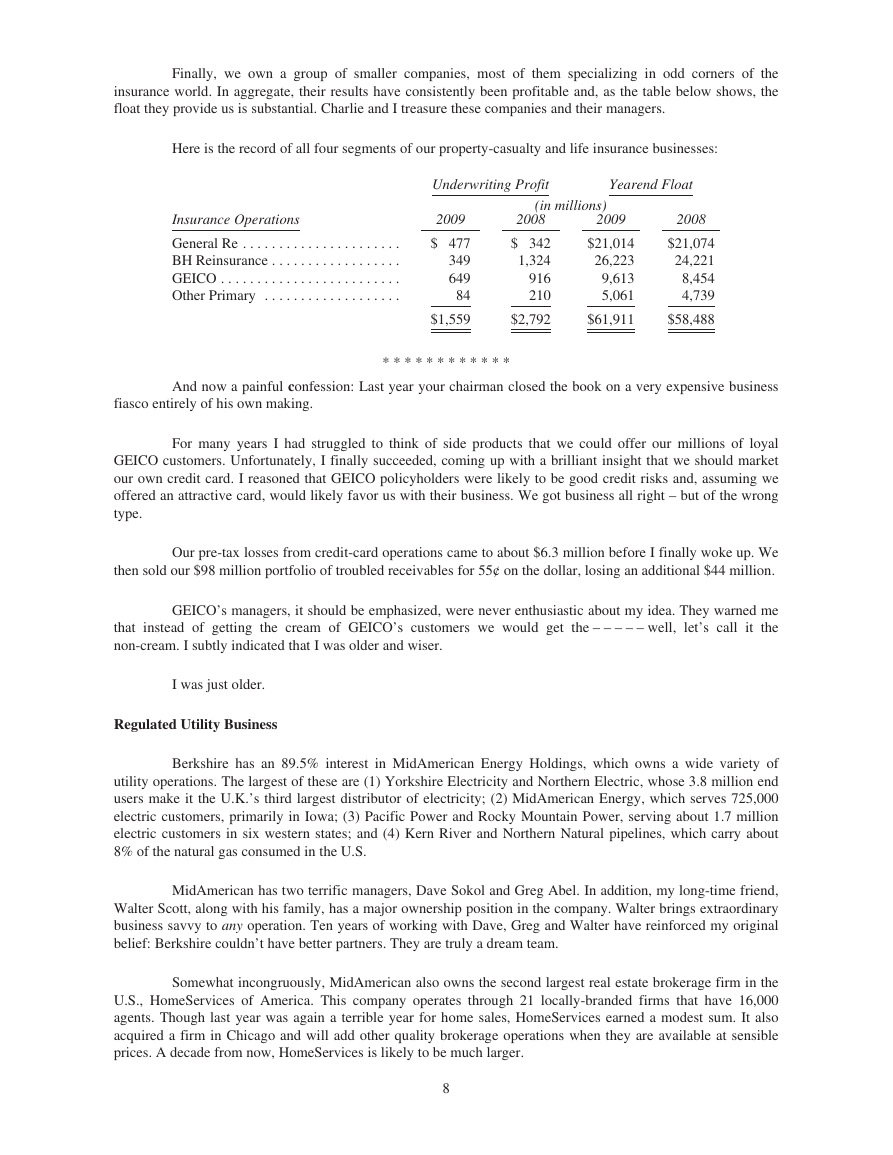

Finally, we own a group of smaller companies, most of them specializing in odd corners of the

insurance world. In aggregate, their results have consistently been profitable and, as the table below shows, the

float they provide us is substantial. Charlie and I treasure these companies and their managers.

Here is the record of all four segments of our property-casualty and life insurance businesses:

Underwriting Profit

Yearend Float

(in millions)

Insurance Operations

General Re . . . . . . . . . . . . . . . . . . . . . .

BH Reinsurance . . . . . . . . . . . . . . . . . .

GEICO . . . . . . . . . . . . . . . . . . . . . . . . .

Other Primary . . . . . . . . . . . . . . . . . . .

2009

$ 477

349

649

84

$1,559

2008

$ 342

1,324

916

210

$2,792

2009

$21,014

26,223

9,613

5,061

$61,911

2008

$21,074

24,221

8,454

4,739

$58,488

And now a painful confession: Last year your chairman closed the book on a very expensive business

fiasco entirely of his own making.

* * * * * * * * * * * *

For many years I had struggled to think of side products that we could offer our millions of loyal

GEICO customers. Unfortunately, I finally succeeded, coming up with a brilliant insight that we should market

our own credit card. I reasoned that GEICO policyholders were likely to be good credit risks and, assuming we

offered an attractive card, would likely favor us with their business. We got business all right – but of the wrong

type.

Our pre-tax losses from credit-card operations came to about $6.3 million before I finally woke up. We

then sold our $98 million portfolio of troubled receivables for 55¢ on the dollar, losing an additional $44 million.

GEICO’s managers, it should be emphasized, were never enthusiastic about my idea. They warned me

that instead of getting the cream of GEICO’s customers we would get the – – – – – well, let’s call it the

non-cream. I subtly indicated that I was older and wiser.

I was just older.

Regulated Utility Business

Berkshire has an 89.5% interest in MidAmerican Energy Holdings, which owns a wide variety of

utility operations. The largest of these are (1) Yorkshire Electricity and Northern Electric, whose 3.8 million end

users make it the U.K.’s third largest distributor of electricity; (2) MidAmerican Energy, which serves 725,000

electric customers, primarily in Iowa; (3) Pacific Power and Rocky Mountain Power, serving about 1.7 million

electric customers in six western states; and (4) Kern River and Northern Natural pipelines, which carry about

8% of the natural gas consumed in the U.S.

MidAmerican has two terrific managers, Dave Sokol and Greg Abel. In addition, my long-time friend,

Walter Scott, along with his family, has a major ownership position in the company. Walter brings extraordinary

business savvy to any operation. Ten years of working with Dave, Greg and Walter have reinforced my original

belief: Berkshire couldn’t have better partners. They are truly a dream team.

Somewhat incongruously, MidAmerican also owns the second largest real estate brokerage firm in the

U.S., HomeServices of America. This company operates through 21 locally-branded firms that have 16,000

agents. Though last year was again a terrible year for home sales, HomeServices earned a modest sum. It also

acquired a firm in Chicago and will add other quality brokerage operations when they are available at sensible

prices. A decade from now, HomeServices is likely to be much larger.

8

�

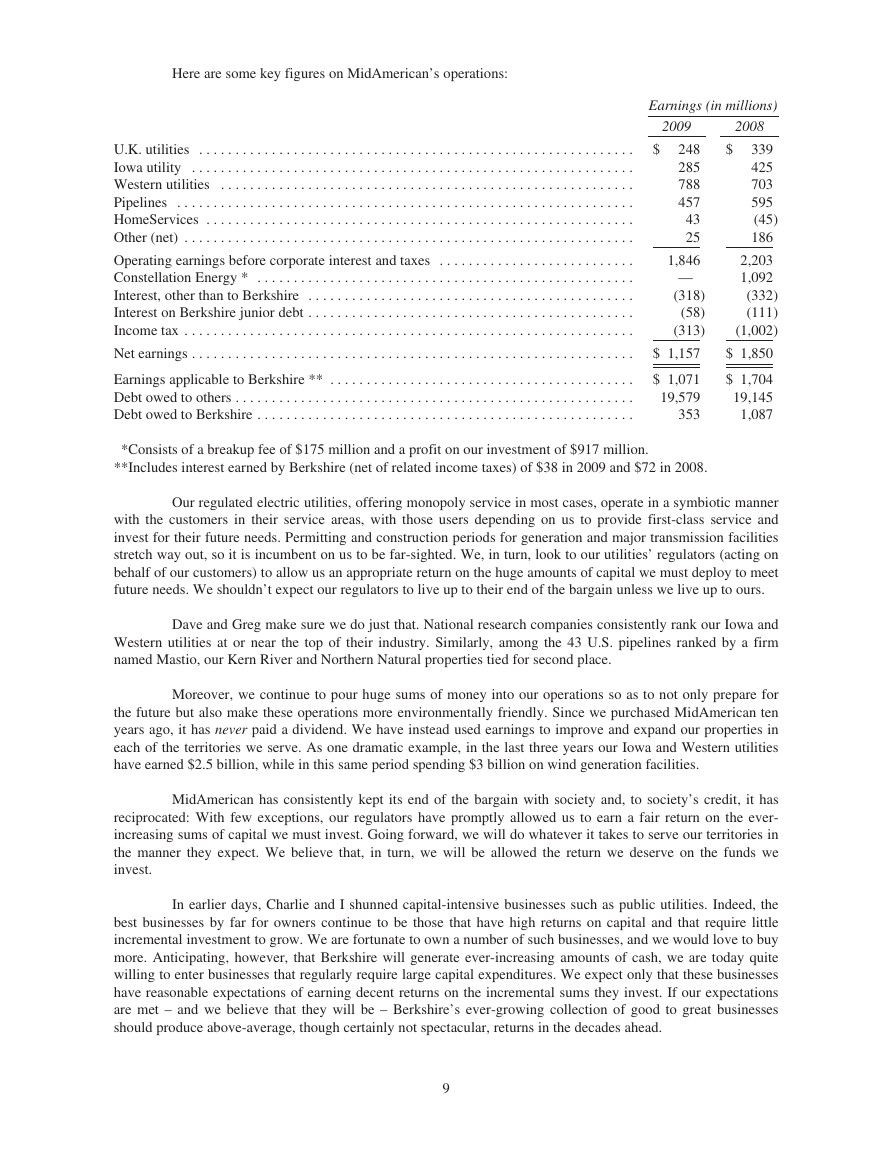

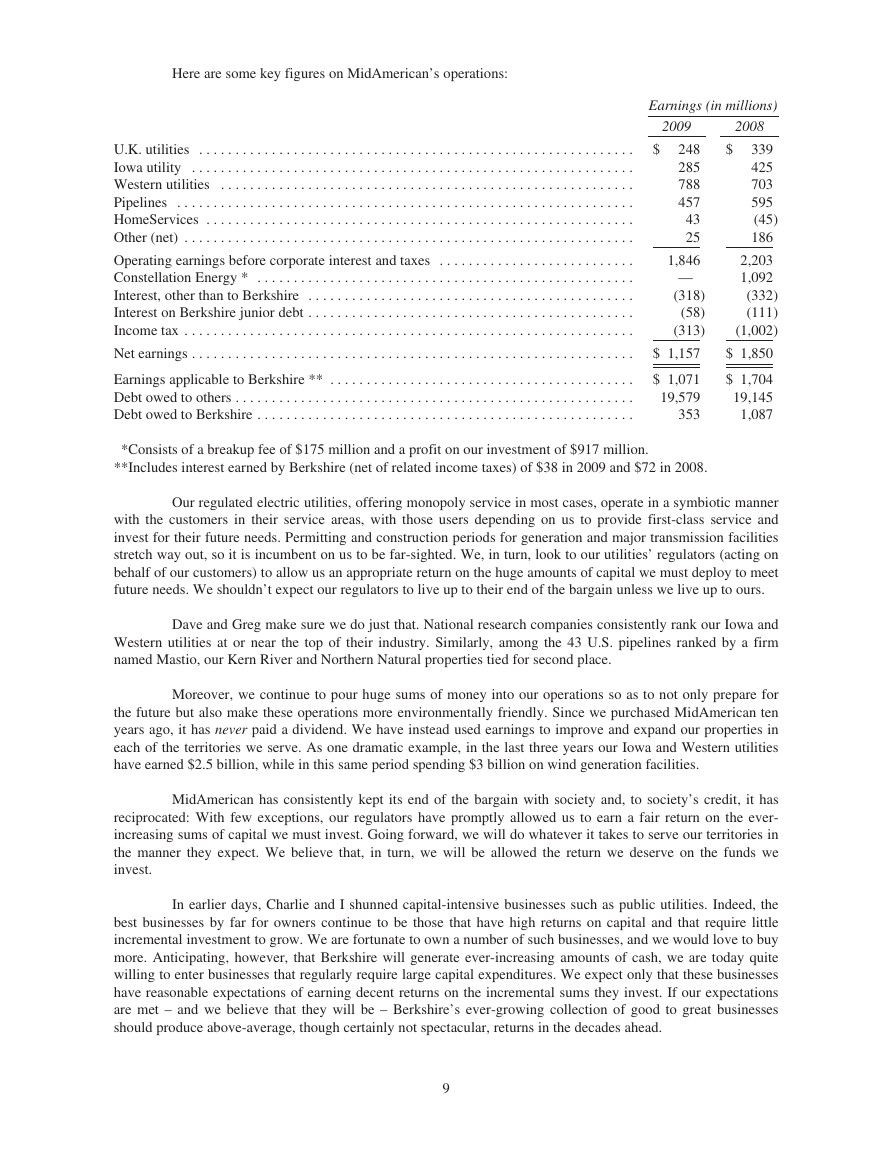

Here are some key figures on MidAmerican’s operations:

Earnings (in millions)

2009

2008

U.K. utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Iowa utility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Western utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Pipelines . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

HomeServices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other (net) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Operating earnings before corporate interest and taxes . . . . . . . . . . . . . . . . . . . . . . . . . . .

Constellation Energy * . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest, other than to Berkshire . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest on Berkshire junior debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Earnings applicable to Berkshire ** . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Debt owed to others . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Debt owed to Berkshire . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

248

285

788

457

43

25

1,846

—

(318)

(58)

(313)

$ 1,157

$ 1,071

19,579

353

$

339

425

703

595

(45)

186

2,203

1,092

(332)

(111)

(1,002)

$ 1,850

$ 1,704

19,145

1,087

*Consists of a breakup fee of $175 million and a profit on our investment of $917 million.

**Includes interest earned by Berkshire (net of related income taxes) of $38 in 2009 and $72 in 2008.

Our regulated electric utilities, offering monopoly service in most cases, operate in a symbiotic manner

with the customers in their service areas, with those users depending on us to provide first-class service and

invest for their future needs. Permitting and construction periods for generation and major transmission facilities

stretch way out, so it is incumbent on us to be far-sighted. We, in turn, look to our utilities’ regulators (acting on

behalf of our customers) to allow us an appropriate return on the huge amounts of capital we must deploy to meet

future needs. We shouldn’t expect our regulators to live up to their end of the bargain unless we live up to ours.

Dave and Greg make sure we do just that. National research companies consistently rank our Iowa and

Western utilities at or near the top of their industry. Similarly, among the 43 U.S. pipelines ranked by a firm

named Mastio, our Kern River and Northern Natural properties tied for second place.

Moreover, we continue to pour huge sums of money into our operations so as to not only prepare for

the future but also make these operations more environmentally friendly. Since we purchased MidAmerican ten

years ago, it has never paid a dividend. We have instead used earnings to improve and expand our properties in

each of the territories we serve. As one dramatic example, in the last three years our Iowa and Western utilities

have earned $2.5 billion, while in this same period spending $3 billion on wind generation facilities.

MidAmerican has consistently kept its end of the bargain with society and, to society’s credit, it has

reciprocated: With few exceptions, our regulators have promptly allowed us to earn a fair return on the ever-

increasing sums of capital we must invest. Going forward, we will do whatever it takes to serve our territories in

the manner they expect. We believe that, in turn, we will be allowed the return we deserve on the funds we

invest.

In earlier days, Charlie and I shunned capital-intensive businesses such as public utilities. Indeed, the

best businesses by far for owners continue to be those that have high returns on capital and that require little

incremental investment to grow. We are fortunate to own a number of such businesses, and we would love to buy

more. Anticipating, however, that Berkshire will generate ever-increasing amounts of cash, we are today quite

willing to enter businesses that regularly require large capital expenditures. We expect only that these businesses

have reasonable expectations of earning decent returns on the incremental sums they invest. If our expectations

are met – and we believe that they will be – Berkshire’s ever-growing collection of good to great businesses

should produce above-average, though certainly not spectacular, returns in the decades ahead.

9

�